In a move to mobilize the Kingdoms private sector and negate over-reliance on oil export, Crown Prince Mohammed Bin Salman has committed to a USD $1.3 trillion (SAR5 trillion) investment drive. The huge pledge has been made with the intent to significantly increase the private sector’s GDP contribution by 2030.

Due to its significant population, prominent hydrocarbons industry and progressively diverse non-oil sector, the Kingdom of Saudi Arabia is one of the world’s wealthiest nations. IMF figures show the Kingdom’s GDP to be larger than that of advanced economies such as Sweden, Norway, and Austria, as well as African giants Egypt and Nigeria.

In a televised announcement, the Crowne Prince described the role of private sector investment as part of a massive SAR 12 trillion plan to jump-start a post-oil era and solidify diversification efforts.

The SAR 12 trillion will include approximately 3 trillion riyals from the country’s sovereign wealth fund and 4 trillion riyals as part of a new Saudi investment strategy.

“What we’re trying to create is growth in Saudi Arabia: growth in GDP, more jobs in Saudi Arabia, more income to the Saudi government, and a better life for Saudis,” Prince Mohammed Bin Salman said in March during a briefing with journalists in Riyadh.

“The new Shareek (Partner) program will help the private sector create hundreds of thousands of new jobs and will boost the contribution of the private sector to GDP by up to 65% by the end of the decade,” the Prince said.

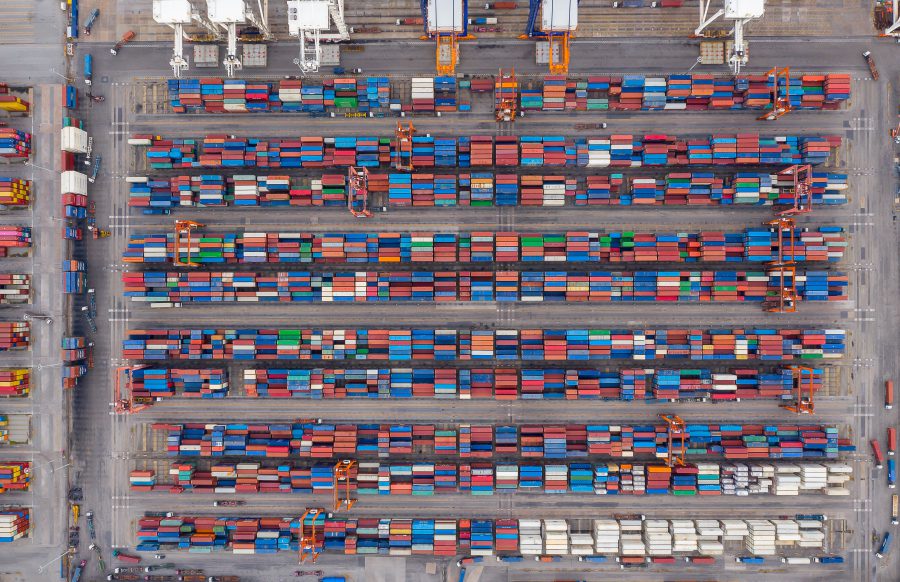

Twenty-four firms including Saudi Basic Industries Corp., Almarai Co., Saudi Telecom Co., and National Shipping Co. have agreed to join the plan, contributing SAR 5 trillion (USD$1.33 trillion) of domestic capital spending over the next 10 years.

Previous reports have noted Saudi Aramco’s intention to sell more shares as part of plans to bolster the nation’s sovereign wealth fund – the Public Investment Fund (PIF) being the main vehicle for boosting Saudi investments both at home and abroad.

The Crowne Prince described how the PIF is working with other sovereign wealth funds in the region on a fund called ‘Invest In Saudi’ that would be sized at between SAR 500 billion to SAR 1 trillion.

Within the GCC, Saudi Arabia is home to the largest stake of private wealth and accounts for approximately 44% of regional capital with additional deployments of wealth in overseas markets.

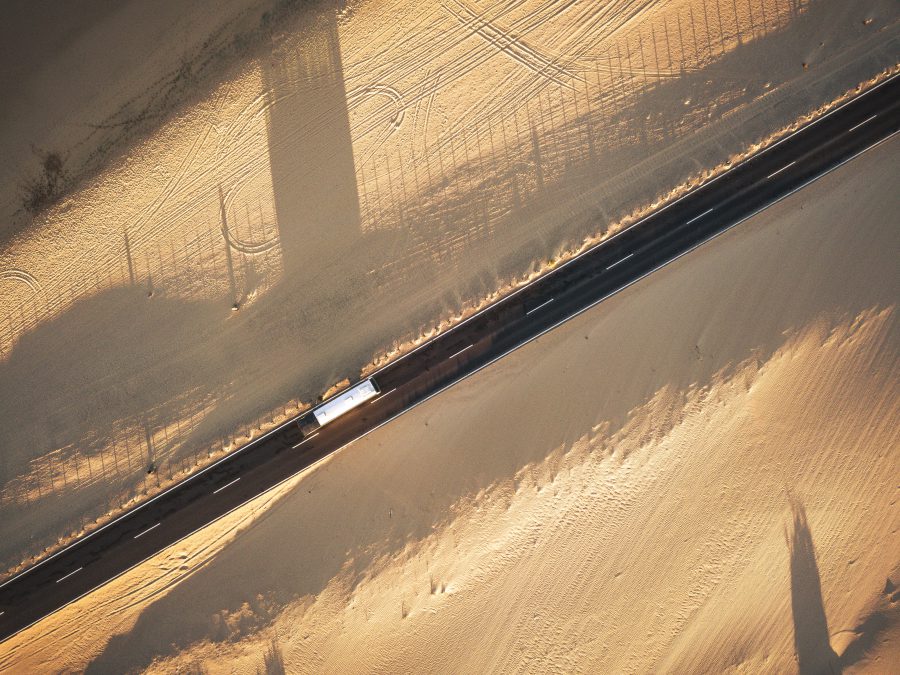

The Saudi PIF is similarly backing domestic mega-projects including the flagship Red Sea Project, the multi-billion dollar Neom economic zone, and the entertainment hub at Qiddya.

Strong Credentials

True to national aspirations, Vision 2030 stresses the value of building a vibrant and prosperous private sector, highlighting it as one of the Kingdom’s national priorities.

Given the importance it represents, further efforts at diversification are likely as the Kingdom looks ahead to a greener, sustainable future as an influential G20 major economy.